Harris Organization/OffshoreAlert trial set to start on July 6, 1999

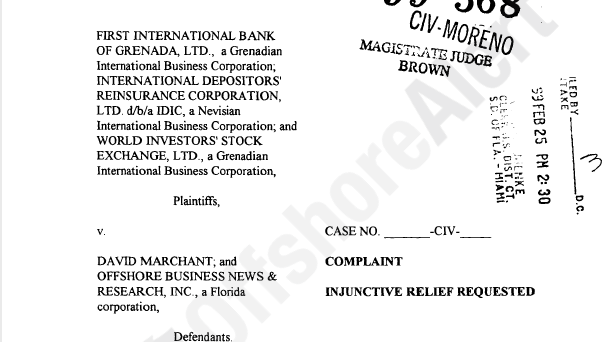

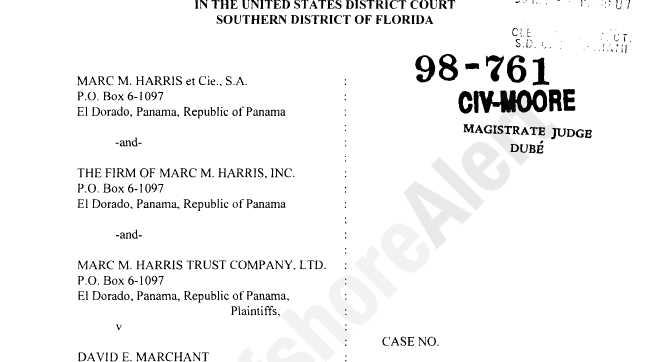

The civil libel trial between Offshore Business News & Research, Inc., which publishes this newsletter, and The Harris Organization financial services group of Panama will start at the United States District Court for the District of Southern Florida (in Miami) on July 6. After two postponements by the court because of scheduling problems, a definite date has now been set for the trial, which is scheduled to last for about one week.