St. Vincent: Money Talks and Nano Walks

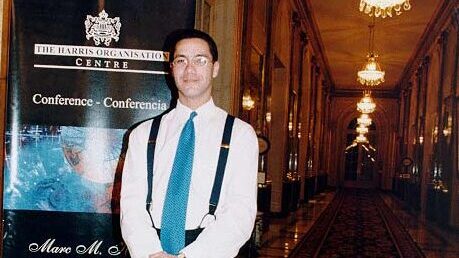

A claim by St Vincent &the Grenadines that it is serious about combating financial crime was dealt a blow on November 22 when it allowed suspected money launderer Thierry Nano to avoid an arrest warrant.Nano flew from the island on