Insider Talking: October 31, 1999

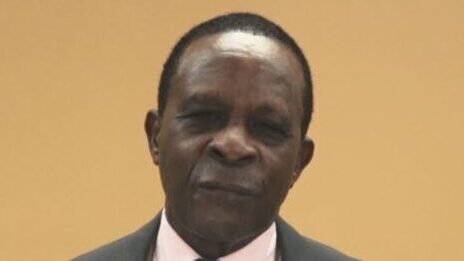

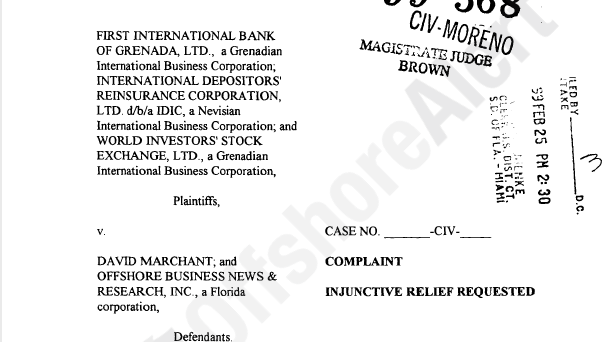

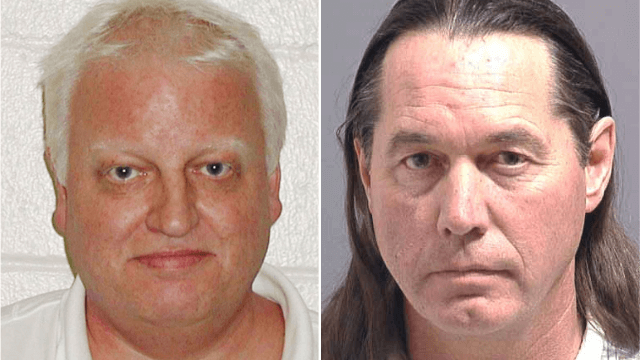

BaTelCo throws spanner in the works of Bahamas International Stock Exchange private placement, Cayman Islands Stock Exchange tells New Utopia to take a hike, trial in Bermuda over European family's wealth costs $600,000 per week, First International Bank of Grenada has difficulty with its math, journalists arrested in Grenada, new sham investment game appears on the Internet, and the growth of the Bahamas is detailed in a prospectus for the new Bahamas International Securities Exchange.