Two more Harris Organization clients deported to US to face criminal charges

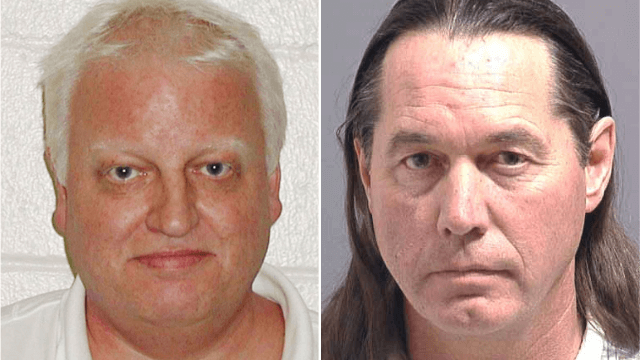

Two more clients of The Harris Organization have been arrested in Panama and deported to their native United States to face trial on criminal charges. Anthony Vigna, 68, and his son, Joseph, 35, were arrested on November 9, 2000 as they left their homes in Panama and immediately flown to Miami, where they are being held in custody.