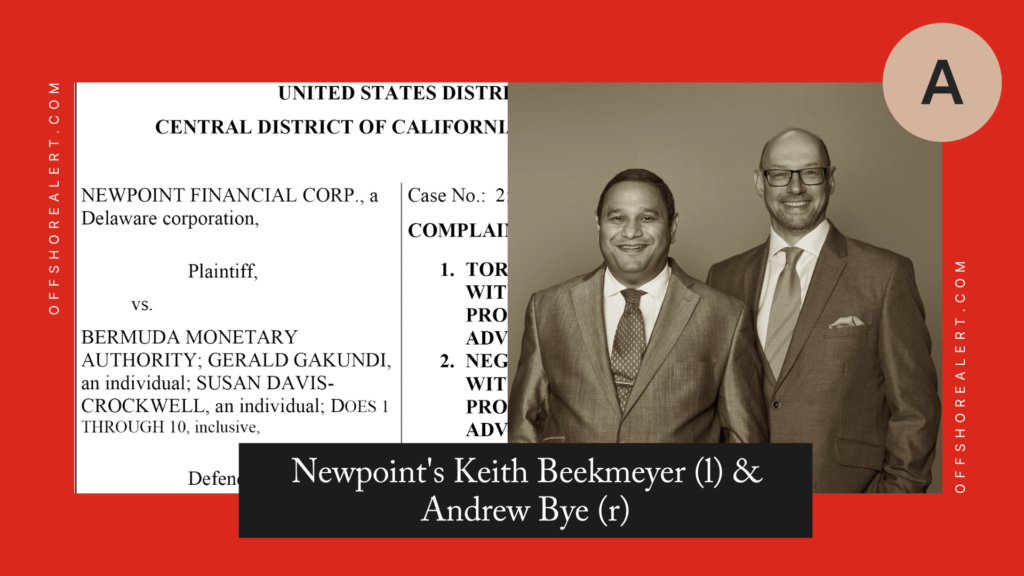

U.S. firm Newpoint Financial sues Bermuda regulator for ‘rejecting acquisition of Citadel Re’

The Bermuda Monetary Authority and two of its employees - Gerald Gakundi and Susan Davis-Crockwell - are being sued for $25 million in California for allegedly rejecting U.S.-based Newpoint Financial Corp's proposed acquisition of Bermuda's Citadel Reinsurance Company after, among other things, receiving information from "the Gibraltar Regulatory Authority".