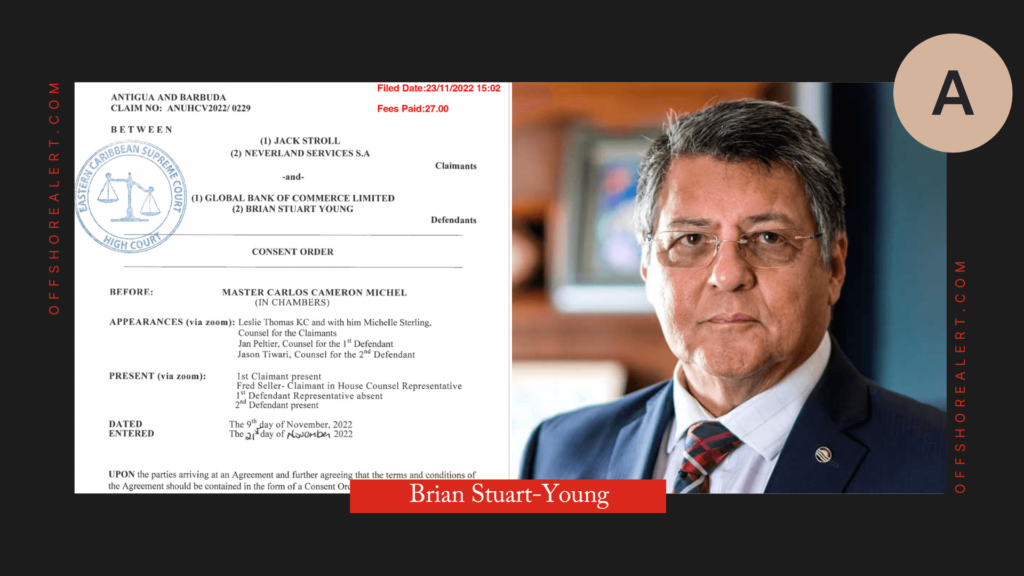

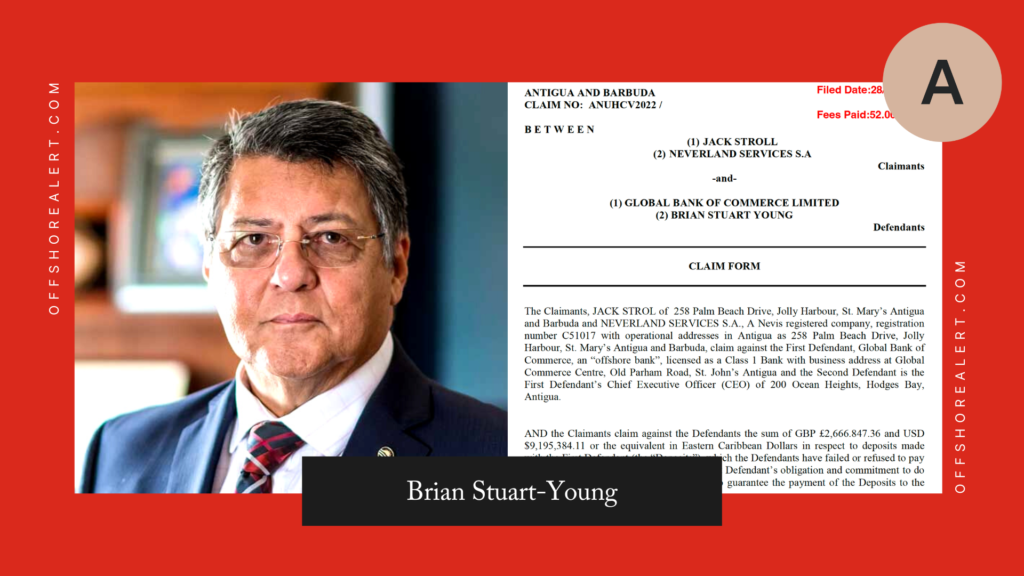

Jack Stroll et al v. Global Bank of Commerce Ltd. et al: Examination Questions (‘Antigua Bank Insolvency’)

Questions for the Examination of Brian Stuart-Young, CEO of Global Bank of Commerce Limited in Jack Stroll, a citizen of Canada residing in Antigua and Barbuda, and Neverland Services S.A., of Nevis v. Global Bank of Commerce Limited, of Antigua and Barbuda, and Brian Stuart-Young at the High Court of Justice for Antigua and Barbuda.