FIBG trial averted as final defendants plead guilty

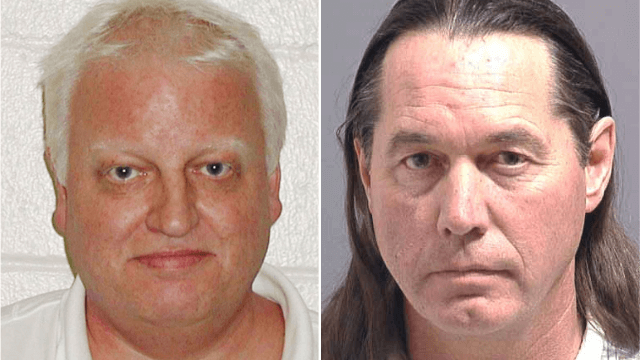

The final two defendants in the criminal prosecution of five former officers and directors of the First International Bank of Grenada have pleaded guilty in the United States, thereby averting a trial into one of the most notorious offshore banking frauds in recent years.Douglas Christie Ferguson, 74, pleaded guilty to one count of conspiracy to commit money laundering and Laurent Barnabe, a 68-year-old Canadian national, pleaded guilty to two counts of money laundering at the U. S. District Court for the District of Oregon on March 19 and March 27, 2006, respectively. Ferguson's plea agreement carries a recommendation that he serve 52 months in prison, while Barnabe's recommended prison-term is six years.